Overview

An accounting degree opens doors to almost any pathway in business with its strong emphasis on essential subjects such as marketing, business, economics, law, financial management, and taxation. This well-rounded programme will provide you with the key financial and accounting skills that are highly sought after by employers..., as well as business and management expertise to help you navigate today’s complex business landscape.

Graduates will gain entry into the professional level of ACCA and CPA Australia. This course will also equip graduates to pursue further professional qualifications with CFA, CFP, CIMA, ICAEW, MIA and RFP, among others.

* This programme received a 100% graduate employability score in the Ministry of Higher Education’s Graduate Employability 2022. (Source: ge.mohe.gov.my/)

Assessments

The assessment includes a combination of examinations, projects and assignments, and finally a requirement to complete a dissertation in Independent Project in the final year. Students will acquire up-to-date vocational skills that are relevant and competitive. This reflects the complex and challenging nature of the accounting, finance and business realms.

Note:

For the latest issues in Accounting from MIA (Malaysian Institute of Accountants), please access their e-magazine, e-Accountants Today, at https://www.at-mia.my/

Academic Requirements

UCSI Foundation year

Minimum CGPA of 2.5

STPM

Pass with C+ or CGPA 2.33 in any 2 subjects

STAM

Pass with a minimum grade of Jayyid (good)

A-Level

Minimum 2 D grades

UEC

Minimum 5 credits (B6)

National Matriculation

Minimum CGPA of 2.5

International Baccalaureate (IB)

Minimum score of 26 points in 6 subjects

Canadian Pre-U

Minimum average of 60% in 6 subjects

AUSMAT/HSC/SACE/TEE/WACE

ATAR score 60% OR minimum 60% average in 5 subjects

Other qualifications deemed equivalent to STPM/A-Level by Malaysian Qualifications Agency

Minimum overall average of 60%

Diploma in Accounting field (Level 4, MQF) or equivalent

Minimum CGPA of 2.5

Other equivalent qualifications

To be reviewed by the faculty on a case-to-case basis

All above qualifications compulsory:

- 1. Credit in Mathematics at SPM level or its equivalent

- 2. Pass in English at SPM level or its equivalent

Note:

Can be waived should any other higher qualification contain Mathematics and English subjects with an equivalent/higher achievement.

Malaysian students using English as the medium of instruction in their previous study or with at least a Band 3 in MUET (CEFR Low B1) or equivalent can be exempted from a pass in the English requirement.

English Language Requirements

For Local Students

MUET

Band 3SPM English Language

Grade B+SPM English Language 1119/O-Level/IGCSE

Grade CSPM English Language CEFR B1

Minimum 2 skills at B1Pearson Test of English

36UEC English Language

Grade A2IELTS

Band 4.0TOEFL iBT

30-31Cambridge English Qualifications and Tests

(ii. Linguaskill Online)

140- If the English language requirement is not met, students may be required to take additional English module(s) prior to or concurrently with the undergraduate program based on the University’s decision.

For International Students

MUET

Band 3.5TOEFL IBT

40TOEFL Essentials (Online)

7.5CEFR

High B1IELTS

5Pearson Test of English

47Cambridge English Qualifications and Tests

(i. B1 Preliminary, B2 First, C1 Advanced C2 Proficiency)

154Cambridge English Qualifications and Tests

(ii. Linguaskill Online)

154Cambridge English Qualifications and Tests

(iii. Occupational English Test (Conventional/Online)

N/AO-Level English/IGCSE

C- International applicants who do not meet the respective academic programme’s English language requirements will need to improve their proficiency by enrolling into the English for Tertiary Education programme (R/KJP/00920-00929).

- Placement into the various levels of the English for Tertiary Education programme depends on the English Language qualification students have at the point of admission and/or the outcome of the English Placement Test.

- The applicants who have met the respective academic programme’s English language requirement may be advised by Faculty to improve their proficiency by undertaking additional English proficiency courses.

- Microeconomics

- Introductory Accounting

- Statistics and its Applications

- Fundamentals of Management

- Business Communication

- Macroeconomics

- Introduction to Financial Reporting

- Business Law

- Co-Operative Placement 1

- Organisational Behaviour

- Fundamentals of Marketing

- Sustainability in Business

- Introduction to Management Accounting

- Company Law

- Intermediate to Financial Reporting

- Accounting Information System

- Financial Management 1

- Intermediate Management Accounting

- Data Analytics for Accounting

- Business Research Method

- Malaysia Taxation

- Corporate Governance, Risk and Professional Ethics

- Co-Operative Placement 2

Elective

- Managing People

- Business System Development Tools

- International Business

- Auditing and Assurance

- Financial Research Project A

- Advanced Management Accounting

- Advanced Financial Reporting

- Financial Management 2

- Malaysian Corporate Taxation

- Advanced Financial Management

- Financial Research Project B

- Advanced Auditing and Assurance

- Integrated Case-study

- Co-Operative Placement 3

Elective

- Strategic Management

- Corporate Finance

- Contemporary Human Resource Management

- Entrepreneurship

- Appreciation of Ethics and Civilisations

(Penghayatan Etika dan Peradaban) - Philosophy and Contemporary Issues

(Falsafah dan Isu Semasa)

- Philosophy and Contemporary Issues

- Communication in Bahasa Melayu 3

(Bahasa Melayu Komunikasi 3)

- U2 - Integriti dan Anti Rasuah (Integrity and Anti-Corruption)

- U2 - University Life

- U4 - Extracurricular Learning Experience 1

- U4 - Extracurricular Learning Experience 2

- U4 - Extracurricular Learning Experience 3

Accounting is a specialised discipline that provides an ideal platform for a career in the field of Accountancy and Finance. Accountants and Auditors is ranked Top 10 as a recession proof jobs in the market. Accountants and auditors are expected to experience much faster than average employment growth in near future. Potential careers of graduates include the following sectors:

- Audit

- Financial Analysis

- Taxation

- Budget Analysis

- Management Accounting

- Banking

- Accountancy

- Strategic Business Consultancy

Chartered Tax Institute of Malaysia

Exempted from 7 papers out of 10 papers

Certified Practising Accountant

Exempted from 6 papers out of 12 papers

Chartered Institute of Management Accountants

Exempted from 7 papers out of 16 papers

Institute of Chartered Accountants in England and Wales (ICAEW)

Exempted from 4 papers out of 15 papers

The Chartered Institute of Public Finance & Accountancy

Exempted from 6 papers out of 12 papers

Association of Chartered Certified Accountants

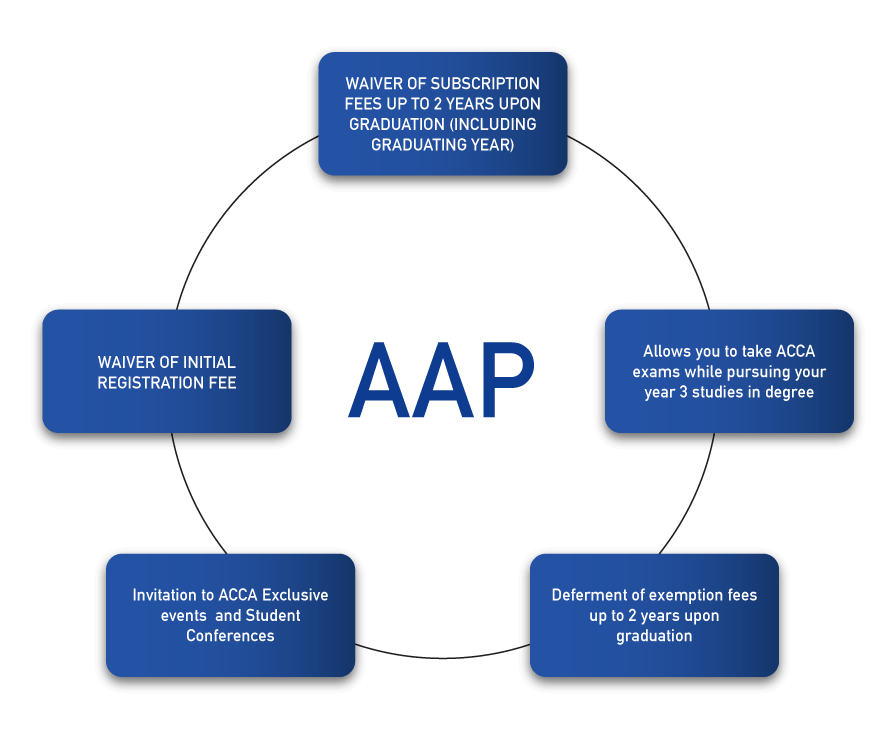

Exempted from 9 papers out of 13 papersACCA accelerate programme

We are the first seven universities in Malaysia which has a partnership with ACCA Accelerated Programme (AAP). Our students are not only eligible for exemptions for all the 9 Foundation papers but also entitle to enjoy the AAP benefits mention below.

Local Students

Approximate Total Fees:

RM 77,195

International Students

Approximate Total Fees:

RM 91,520

Note:

- This is an estimated fee, as different countries have different visa processing charges and administrative fees. For more information, kindly refer to your region’s counselor for the detailed fee breakdown.

- In accordance with the Malaysian government tax regulation, effective 1st July 2025, a 6% service tax will be imposed on non-Malaysian citizens.

| IDP Programme | Pathway | University | Country | Fee |

|---|---|---|---|---|

| B Commerce Major: Accounting / Business Information Systems / Finance | 1.5+1.5 | University of Queensland | Australia | AUD 48,160 |

For enquiry, please contact us at [email protected] or call us at +603 9101 8880 ext 2066.